NEWS

NEWS

23 Jan 2026

23 Jan 2026

How Whisper Networks Shape Women’s Careers in Finance in 2026

How Whisper Networks Shape Women’s Careers in Finance in 2026

The finance industry today tends to claim that it’s mature enough. It points to compliance teams, HR policies, and “zero tolerance” rules on workplace misconduct — harassment, discrimination, bullying, and retaliation — as proof. But recent reporting shows another side.

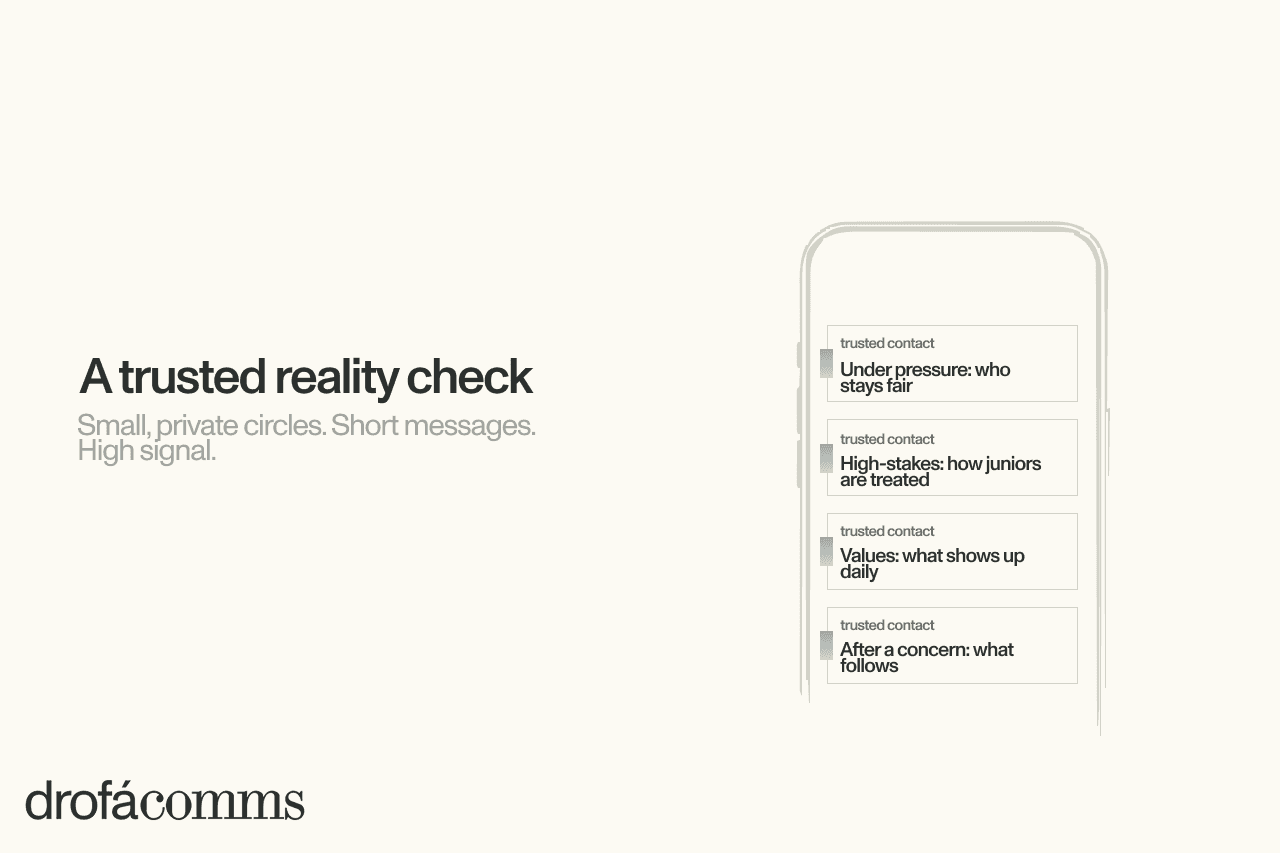

In January 2026, Forbes highlighted that many women in finance still rely on whisper networks. These are informal circles where women share honest, practical information about teams, managers, and workplace culture. They are the kind of “reality check” that is hard to get from official statements alone.

At first glance, whisper networks can look like a negative phenomenon, because they often grow in places where formal channels do not feel safe or reliable. Yet, they also reflect progress.

Women are sharing knowledge, warning each other early, and helping each other move toward healthier teams and better roles. In 2026, when markets are volatile, geopolitics is tense, and technology is changing fast, trusted connections can matter as much as formal rules.

So, let’s take a closer look at what whisper networks are, what they actually carry, and how they help women in finance make smarter career decisions.

What Are Whisper Networks in Finance?

Researchers describe whisper networks as informal communication circles that women use to share information about sexual harassment and other workplace risks. In practice, the conversations usually cover more than one topic. People share what they have learned about:

How a team behaves under pressure.

How managers treat junior staff, especially in high-stakes moments.

Which “values” are real in daily work, and which ones stay in documents?

What happens after someone raises a concern?

This also explains the format. Whisper networks are small, trust-based, and often private. They do not look like a formal women’s network with a membership list and a calendar. The value is speed and honesty: if the message comes from someone you trust, even a short note can help you avoid a bad move and save months of stress.

In finance, this matters more than many people admit. Teams change fast, business cycles are sharp, and reputational risk spreads quickly in a tight, unpredictable market.

What Whisper Networks Share Day to Day

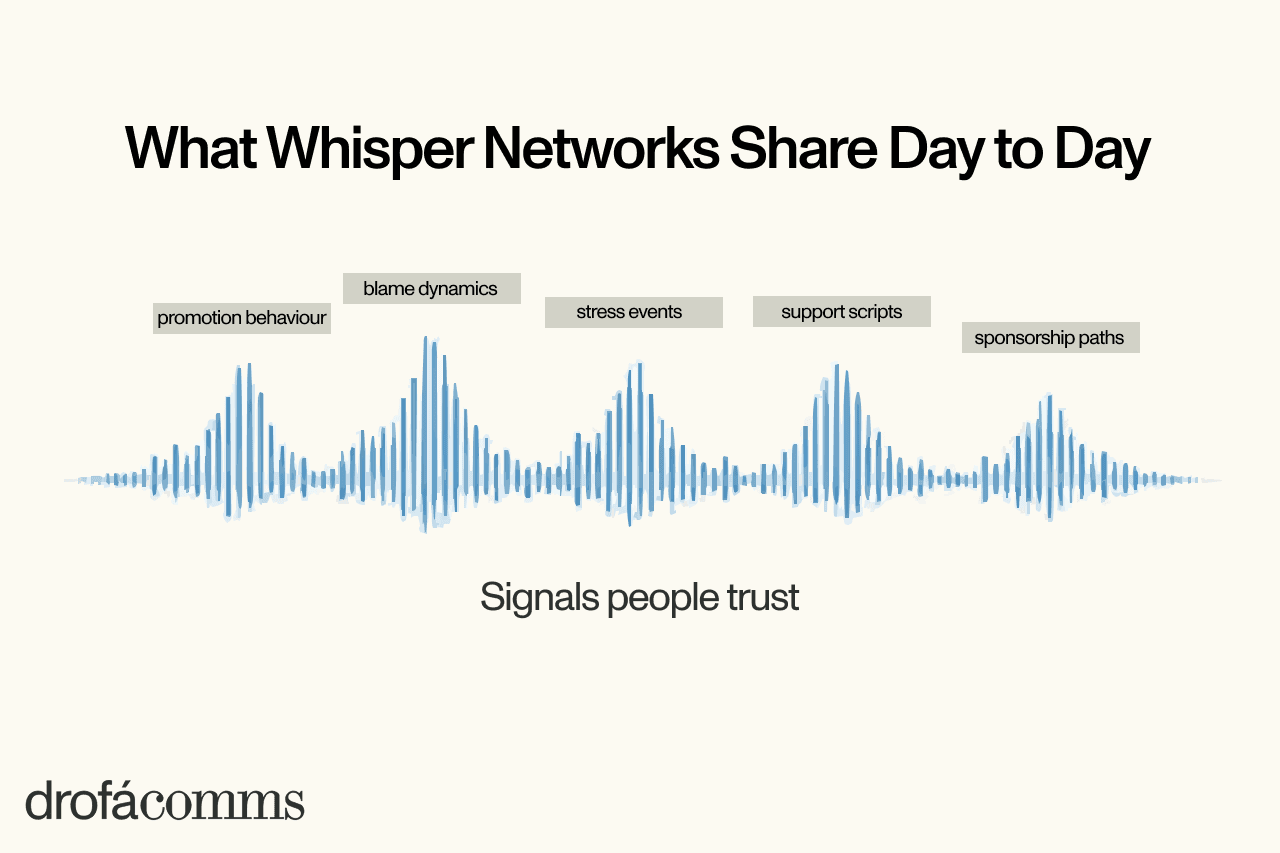

It is easy to reduce whisper networks to “warnings about bad actors.” That is only part of the story, though. The bigger value is what these networks carry day to day. They work like a practical “reality layer” on top of official narratives.

From what we see as a communications team working with finance and fintech leaders, whisper networks typically carry four types of information:

Context that turns a rumour into a concrete sign. Not “this place is toxic,” but what exactly happens: pressure style, feedback culture, blame dynamics, promotion behaviour, how mistakes are handled.

A reputation map of teams, not only brands. Finance brands can look similar from the outside. Inside, the experience can differ strongly by desk, region, and manager. Whisper networks often talk about the unit, instead of the logo.

Practical scripts for self-protection. They include how to document issues, which questions to ask in interviews, and what to clarify in writing before joining.

Opportunity intelligence. This is about where women actually get sponsorship, visibility, and stretch projects. Also, it reveals who is known to promote talent fairly and which teams invest in skills.

All of that underscores that whisper networks are a tool for better decisions. They help women filter noise, understand the real culture behind a brand, and choose safer paths to grow.

How Whisper Networks Help Women in Finance in 2026

As mentioned, in 2026, whisper networks matter less as “emergency channels” and more as tools for better decisions. The year is already defined by unstable geopolitics, shifting regulations, and rapid technological change. So, in that environment, women in finance use trusted networks in three practical ways.

Career risk reduction

Finance careers often involve frequent role and desk changes, cross-border shifts, and switches between banks, funds, fintech, and infrastructure. A move can look perfect on paper and still go wrong if the culture is misaligned.

Whisper networks help women check the “soft risk” early:

Is this manager known for building people or burning them?

Does the team reward delivery, or reward proximity and loyalty?

What happens when someone makes a mistake?

How does the team behave during stress events, restructuring, or a market drawdown?

This is due diligence in human terms. It helps avoid decisions that cost time, confidence, and reputation.

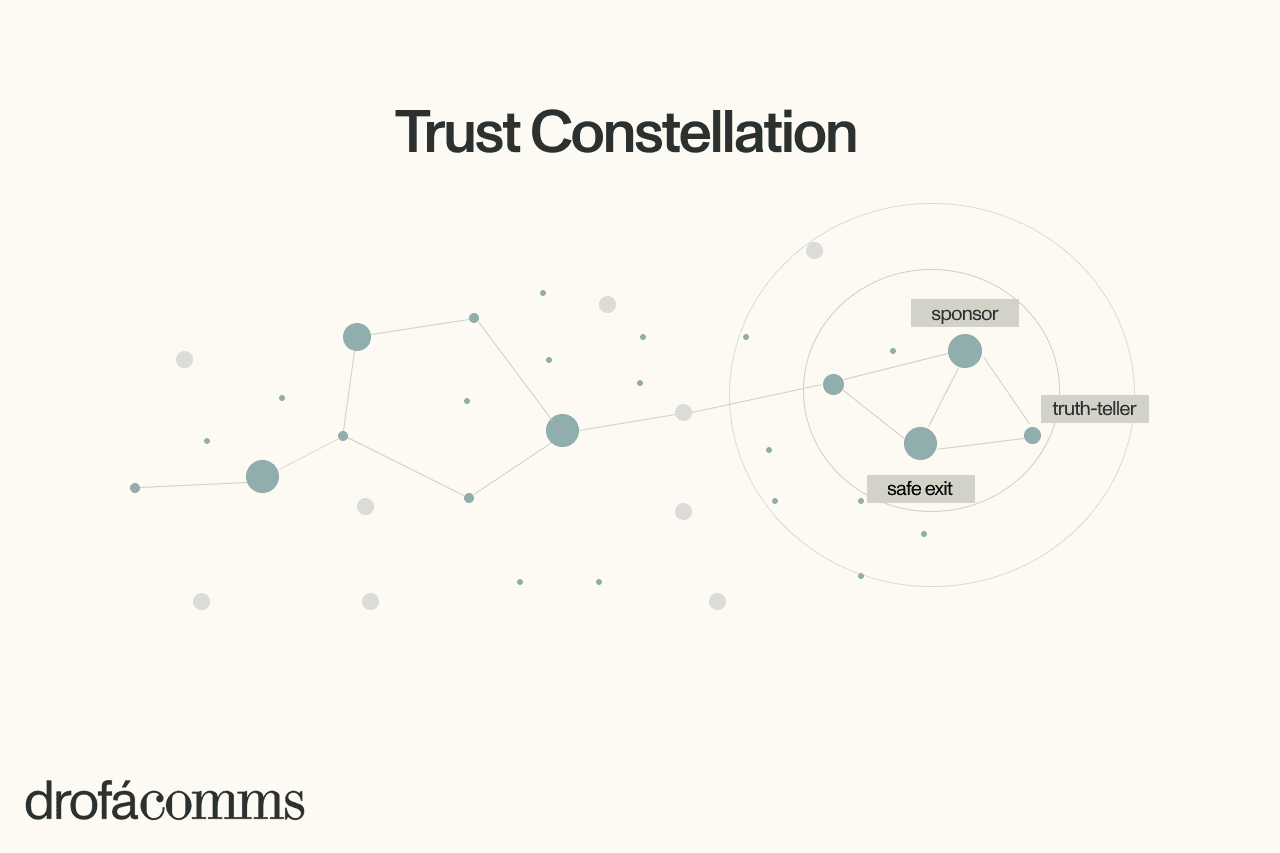

Better access to support and sponsorship

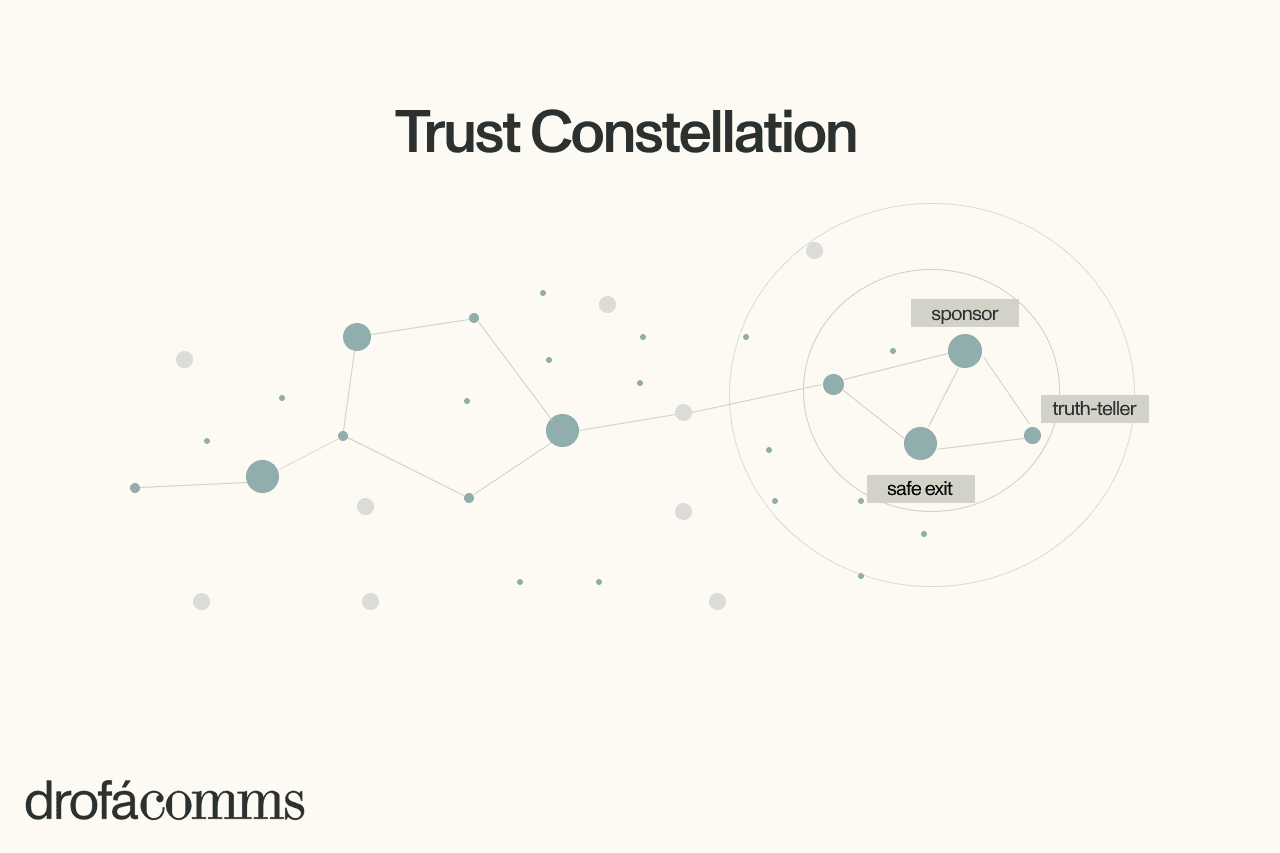

Formal mentoring programmes exist in many firms. Still, their quality varies. Whisper networks often do a different job — they connect women to people who will actually respond.

It’s really noticeable from our interview work on the Women Leading the Way journal. Women rarely say they need “advice” in the abstract. They need two things that are more concrete:

A person who will open a door (sponsorship).

A person who will tell the truth about the room (context).

Whisper networks can do both. They tell you who is credible, who is safe to approach, who is generous with time, and who has a track record of helping others move forward. That is also why the WEF framing of networks as a strategic asset resonates. In uncertain conditions, trusted circles strengthen decision-making and resilience.

Adaptation to technological change

AI is changing work everywhere, let alone the finance industry. Research, reporting, compliance workflows, customer support, and even parts of trading operations — all are affected. For women, the hard part is to keep their role and influence intact while work gets reshaped.

Whisper networks help women find answers early.

They show which skills are valued right now and which roles are quietly changing. They also reveal how different teams use automation in real life. For instance, in some places it supports people and improves work, while in others it mainly reduces headcount. And they make one more thing visible right away — which teams invest in training, and which teams expect you to “figure it out” on your own.

So, everything they need is situational awareness. And trusted exchange gives that awareness faster than official comms, especially during change.

Conclusion

Whisper networks should be treated as an industry marker. They exist because trust is still uneven. Policies can look strong on paper, and people can still hesitate to use formal channels when they fear career consequences.

At Drofa Comms, we think the goal is to make “whispers” less necessary as a safety tool by making trust real. That means predictable processes, genuine protection from retaliation, and leadership accountability that employees can see in action. Women, in turn, should treat networks as career infrastructure: invest in relationships, share context responsibly, and build circles where honest advice and support are normal.

The finance industry today tends to claim that it’s mature enough. It points to compliance teams, HR policies, and “zero tolerance” rules on workplace misconduct — harassment, discrimination, bullying, and retaliation — as proof. But recent reporting shows another side.

In January 2026, Forbes highlighted that many women in finance still rely on whisper networks. These are informal circles where women share honest, practical information about teams, managers, and workplace culture. They are the kind of “reality check” that is hard to get from official statements alone.

At first glance, whisper networks can look like a negative phenomenon, because they often grow in places where formal channels do not feel safe or reliable. Yet, they also reflect progress.

Women are sharing knowledge, warning each other early, and helping each other move toward healthier teams and better roles. In 2026, when markets are volatile, geopolitics is tense, and technology is changing fast, trusted connections can matter as much as formal rules.

So, let’s take a closer look at what whisper networks are, what they actually carry, and how they help women in finance make smarter career decisions.

What Are Whisper Networks in Finance?

Researchers describe whisper networks as informal communication circles that women use to share information about sexual harassment and other workplace risks. In practice, the conversations usually cover more than one topic. People share what they have learned about:

How a team behaves under pressure.

How managers treat junior staff, especially in high-stakes moments.

Which “values” are real in daily work, and which ones stay in documents?

What happens after someone raises a concern?

This also explains the format. Whisper networks are small, trust-based, and often private. They do not look like a formal women’s network with a membership list and a calendar. The value is speed and honesty: if the message comes from someone you trust, even a short note can help you avoid a bad move and save months of stress.

In finance, this matters more than many people admit. Teams change fast, business cycles are sharp, and reputational risk spreads quickly in a tight, unpredictable market.

What Whisper Networks Share Day to Day

It is easy to reduce whisper networks to “warnings about bad actors.” That is only part of the story, though. The bigger value is what these networks carry day to day. They work like a practical “reality layer” on top of official narratives.

From what we see as a communications team working with finance and fintech leaders, whisper networks typically carry four types of information:

Context that turns a rumour into a concrete sign. Not “this place is toxic,” but what exactly happens: pressure style, feedback culture, blame dynamics, promotion behaviour, how mistakes are handled.

A reputation map of teams, not only brands. Finance brands can look similar from the outside. Inside, the experience can differ strongly by desk, region, and manager. Whisper networks often talk about the unit, instead of the logo.

Practical scripts for self-protection. They include how to document issues, which questions to ask in interviews, and what to clarify in writing before joining.

Opportunity intelligence. This is about where women actually get sponsorship, visibility, and stretch projects. Also, it reveals who is known to promote talent fairly and which teams invest in skills.

All of that underscores that whisper networks are a tool for better decisions. They help women filter noise, understand the real culture behind a brand, and choose safer paths to grow.

How Whisper Networks Help Women in Finance in 2026

As mentioned, in 2026, whisper networks matter less as “emergency channels” and more as tools for better decisions. The year is already defined by unstable geopolitics, shifting regulations, and rapid technological change. So, in that environment, women in finance use trusted networks in three practical ways.

Career risk reduction

Finance careers often involve frequent role and desk changes, cross-border shifts, and switches between banks, funds, fintech, and infrastructure. A move can look perfect on paper and still go wrong if the culture is misaligned.

Whisper networks help women check the “soft risk” early:

Is this manager known for building people or burning them?

Does the team reward delivery, or reward proximity and loyalty?

What happens when someone makes a mistake?

How does the team behave during stress events, restructuring, or a market drawdown?

This is due diligence in human terms. It helps avoid decisions that cost time, confidence, and reputation.

Better access to support and sponsorship

Formal mentoring programmes exist in many firms. Still, their quality varies. Whisper networks often do a different job — they connect women to people who will actually respond.

It’s really noticeable from our interview work on the Women Leading the Way journal. Women rarely say they need “advice” in the abstract. They need two things that are more concrete:

A person who will open a door (sponsorship).

A person who will tell the truth about the room (context).

Whisper networks can do both. They tell you who is credible, who is safe to approach, who is generous with time, and who has a track record of helping others move forward. That is also why the WEF framing of networks as a strategic asset resonates. In uncertain conditions, trusted circles strengthen decision-making and resilience.

Adaptation to technological change

AI is changing work everywhere, let alone the finance industry. Research, reporting, compliance workflows, customer support, and even parts of trading operations — all are affected. For women, the hard part is to keep their role and influence intact while work gets reshaped.

Whisper networks help women find answers early.

They show which skills are valued right now and which roles are quietly changing. They also reveal how different teams use automation in real life. For instance, in some places it supports people and improves work, while in others it mainly reduces headcount. And they make one more thing visible right away — which teams invest in training, and which teams expect you to “figure it out” on your own.

So, everything they need is situational awareness. And trusted exchange gives that awareness faster than official comms, especially during change.

Conclusion

Whisper networks should be treated as an industry marker. They exist because trust is still uneven. Policies can look strong on paper, and people can still hesitate to use formal channels when they fear career consequences.

At Drofa Comms, we think the goal is to make “whispers” less necessary as a safety tool by making trust real. That means predictable processes, genuine protection from retaliation, and leadership accountability that employees can see in action. Women, in turn, should treat networks as career infrastructure: invest in relationships, share context responsibly, and build circles where honest advice and support are normal.

The finance industry today tends to claim that it’s mature enough. It points to compliance teams, HR policies, and “zero tolerance” rules on workplace misconduct — harassment, discrimination, bullying, and retaliation — as proof. But recent reporting shows another side.

In January 2026, Forbes highlighted that many women in finance still rely on whisper networks. These are informal circles where women share honest, practical information about teams, managers, and workplace culture. They are the kind of “reality check” that is hard to get from official statements alone.

At first glance, whisper networks can look like a negative phenomenon, because they often grow in places where formal channels do not feel safe or reliable. Yet, they also reflect progress.

Women are sharing knowledge, warning each other early, and helping each other move toward healthier teams and better roles. In 2026, when markets are volatile, geopolitics is tense, and technology is changing fast, trusted connections can matter as much as formal rules.

So, let’s take a closer look at what whisper networks are, what they actually carry, and how they help women in finance make smarter career decisions.

What Are Whisper Networks in Finance?

Researchers describe whisper networks as informal communication circles that women use to share information about sexual harassment and other workplace risks. In practice, the conversations usually cover more than one topic. People share what they have learned about:

How a team behaves under pressure.

How managers treat junior staff, especially in high-stakes moments.

Which “values” are real in daily work, and which ones stay in documents?

What happens after someone raises a concern?

This also explains the format. Whisper networks are small, trust-based, and often private. They do not look like a formal women’s network with a membership list and a calendar. The value is speed and honesty: if the message comes from someone you trust, even a short note can help you avoid a bad move and save months of stress.

In finance, this matters more than many people admit. Teams change fast, business cycles are sharp, and reputational risk spreads quickly in a tight, unpredictable market.

What Whisper Networks Share Day to Day

It is easy to reduce whisper networks to “warnings about bad actors.” That is only part of the story, though. The bigger value is what these networks carry day to day. They work like a practical “reality layer” on top of official narratives.

From what we see as a communications team working with finance and fintech leaders, whisper networks typically carry four types of information:

Context that turns a rumour into a concrete sign. Not “this place is toxic,” but what exactly happens: pressure style, feedback culture, blame dynamics, promotion behaviour, how mistakes are handled.

A reputation map of teams, not only brands. Finance brands can look similar from the outside. Inside, the experience can differ strongly by desk, region, and manager. Whisper networks often talk about the unit, instead of the logo.

Practical scripts for self-protection. They include how to document issues, which questions to ask in interviews, and what to clarify in writing before joining.

Opportunity intelligence. This is about where women actually get sponsorship, visibility, and stretch projects. Also, it reveals who is known to promote talent fairly and which teams invest in skills.

All of that underscores that whisper networks are a tool for better decisions. They help women filter noise, understand the real culture behind a brand, and choose safer paths to grow.

How Whisper Networks Help Women in Finance in 2026

As mentioned, in 2026, whisper networks matter less as “emergency channels” and more as tools for better decisions. The year is already defined by unstable geopolitics, shifting regulations, and rapid technological change. So, in that environment, women in finance use trusted networks in three practical ways.

Career risk reduction

Finance careers often involve frequent role and desk changes, cross-border shifts, and switches between banks, funds, fintech, and infrastructure. A move can look perfect on paper and still go wrong if the culture is misaligned.

Whisper networks help women check the “soft risk” early:

Is this manager known for building people or burning them?

Does the team reward delivery, or reward proximity and loyalty?

What happens when someone makes a mistake?

How does the team behave during stress events, restructuring, or a market drawdown?

This is due diligence in human terms. It helps avoid decisions that cost time, confidence, and reputation.

Better access to support and sponsorship

Formal mentoring programmes exist in many firms. Still, their quality varies. Whisper networks often do a different job — they connect women to people who will actually respond.

It’s really noticeable from our interview work on the Women Leading the Way journal. Women rarely say they need “advice” in the abstract. They need two things that are more concrete:

A person who will open a door (sponsorship).

A person who will tell the truth about the room (context).

Whisper networks can do both. They tell you who is credible, who is safe to approach, who is generous with time, and who has a track record of helping others move forward. That is also why the WEF framing of networks as a strategic asset resonates. In uncertain conditions, trusted circles strengthen decision-making and resilience.

Adaptation to technological change

AI is changing work everywhere, let alone the finance industry. Research, reporting, compliance workflows, customer support, and even parts of trading operations — all are affected. For women, the hard part is to keep their role and influence intact while work gets reshaped.

Whisper networks help women find answers early.

They show which skills are valued right now and which roles are quietly changing. They also reveal how different teams use automation in real life. For instance, in some places it supports people and improves work, while in others it mainly reduces headcount. And they make one more thing visible right away — which teams invest in training, and which teams expect you to “figure it out” on your own.

So, everything they need is situational awareness. And trusted exchange gives that awareness faster than official comms, especially during change.

Conclusion

Whisper networks should be treated as an industry marker. They exist because trust is still uneven. Policies can look strong on paper, and people can still hesitate to use formal channels when they fear career consequences.

At Drofa Comms, we think the goal is to make “whispers” less necessary as a safety tool by making trust real. That means predictable processes, genuine protection from retaliation, and leadership accountability that employees can see in action. Women, in turn, should treat networks as career infrastructure: invest in relationships, share context responsibly, and build circles where honest advice and support are normal.

London office

Rise, created by Barclays, 41 Luke St, London EC2A 4DP

Nicosia office

2043, Nikokreontos 29, office 202

DP FINANCE COMM LTD (#13523955) Registered Address: N1 7GU, 20-22 Wenlock Road, London, United Kingdom For Operations In The UK

AGAFIYA CONSULTING LTD (#HE 380737) Registered Address: 2043, Nikokreontos 29, Flat 202, Strovolos, Cyprus For Operations In The EU, LATAM, United Stated Of America And Provision Of Services Worldwide

Drofa © 2024

London office

Rise, created by Barclays, 41 Luke St, London EC2A 4DP

Nicosia office

2043, Nikokreontos 29, office 202

DP FINANCE COMM LTD (#13523955) Registered Address: N1 7GU, 20-22 Wenlock Road, London, United Kingdom For Operations In The UK

AGAFIYA CONSULTING LTD (#HE 380737) Registered Address: 2043, Nikokreontos 29, Flat 202, Strovolos, Cyprus For Operations In The EU, LATAM, United Stated Of America And Provision Of Services Worldwide

Drofa © 2024

London office

Rise, created by Barclays, 41 Luke St, London EC2A 4DP

Nicosia office

2043, Nikokreontos 29, office 202

DP FINANCE COMM LTD (#13523955) Registered Address: N1 7GU, 20-22 Wenlock Road, London, United Kingdom For Operations In The UK

AGAFIYA CONSULTING LTD (#HE 380737) Registered Address: 2043, Nikokreontos 29, Flat 202, Strovolos, Cyprus For Operations In The EU, LATAM, United Stated Of America And Provision Of Services Worldwide

Drofa © 2024